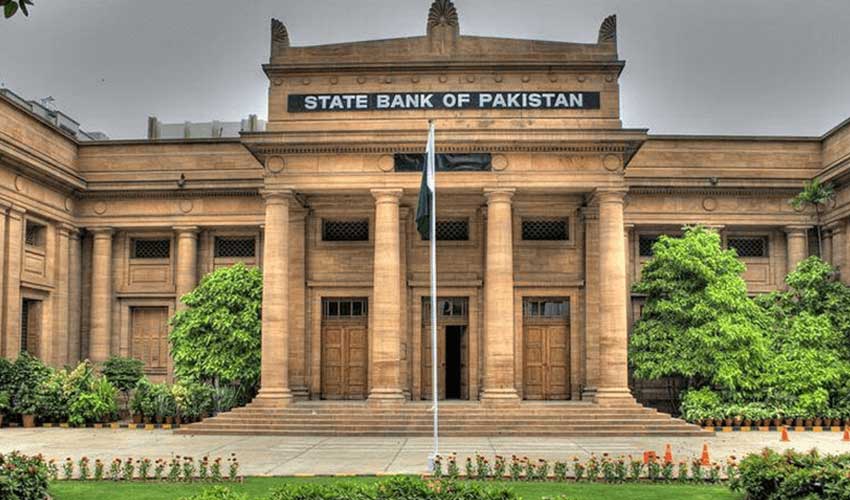

The State Bank of Pakistan (SBP) has officially withdrawn its earlier advisory declaring cryptocurrency illegal, the Deputy Governor of the central bank informed the Senate Standing Committee on Finance during a meeting on Wednesday.

The development marks a significant step toward shaping Pakistan’s digital asset landscape as lawmakers weigh the Virtual Asset Bill in detail.

Advisory withdrawn, digital currency planned

The SBP deputy governor clarified that the central bank will now be authorized to issue its own Central Bank Digital Currency (CBDC), with its value equal to one Pakistani rupee. He explained that money held in bank accounts will also be treated as digital currency, with the difference lying only in the method of use.

The law secretary briefed the committee that crimes linked to crypto trading will fall under anti-money laundering (AML) laws.

Opposition to $10,000 holding limit

During the meeting, members opposed the proposal to cap digital currency holdings at $10,000, arguing that such a limit would restrict investors and traders. Instead, senators suggested a more inclusive approach to developing Pakistan’s digital economy.

A proposal was floated to ensure that members of the proposed Crypto Authority must have at least five years of relevant experience. Lawmakers also emphasized the need to include more young professionals in the authority to make it future-ready.

Senators voice concerns, criticism

Senator Afnanullah Khan strongly opposed allowing any member of the authority to trade in cryptocurrency themselves, citing conflict of interest. He also claimed that Pakistanis have already invested $21 billion in digital currencies.

The session also turned heated when Senator Afnanullah accused the Law Secretary of stealing his proposed bill. “You should be ashamed of yourself for stealing my bill,” he said angrily. Committee Chairman Senator Saleem Mandviwala backed him, criticizing the government for what he called a habit of ignoring private members’ bills until it becomes convenient to take credit for them.

Crypto mining and Chinese interest

The committee also discussed the growing interest in crypto mining. Senator Mandviwala revealed that several Chinese companies have contacted Pakistan, offering to set up mining operations by generating their own electricity. However, he noted that the high cost of electricity in Pakistan remains a major obstacle to large-scale mining ventures.

“Crypto mining depends on the business model. If the model is right, investors will come,” he remarked.

Formation of subcommittee

To further evaluate the Virtual Asset Bill, the Senate Standing Committee formed a subcommittee tasked with reviewing the draft in detail and recommending revisions.