The livestock sector in Pakistan is a vital economic and social pillar, underpinning agricultural productivity and rural livelihoods across the country. It contributes over 63.6% of agricultural GDP and roughly 14.9% of national GDP, underscoring its immense significance not only in food production but also in employment and income generation for millions of farmers.

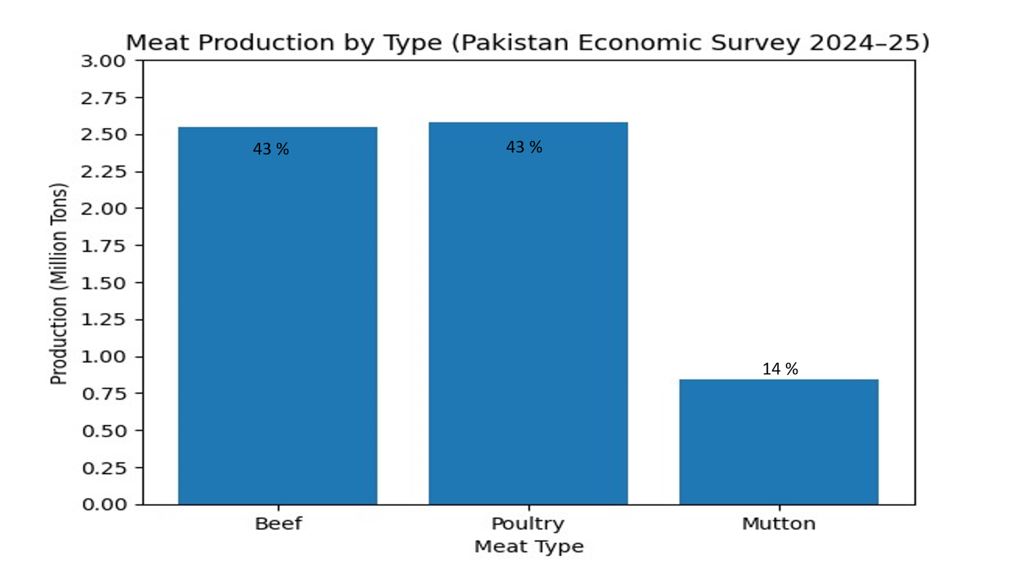

Pakistan is one of the top global producers of meat, including beef from cattle and buffalo, as well as mutton from sheep and goat meat. In 2024–25, the country produced approximately 2.2 million tons of beef, with buffalo meat comprising a significant share. Beyond beef, the consumption and production of other meat types such as mutton and poultry are also substantial and growing.

The overall per capita meat consumption in Pakistan is increasing, projected to reach about 10.4 kg in 2025, driven by rising urban demand and shifting dietary preferences towards higher protein intake.

This increase reflects a balanced consumption of beef, mutton, goat, and poultry meats, all of which play crucial roles in nutrition and food security.

The expanding meat industry is vital not only for meeting domestic nutrition needs but also for generating significant economic value through domestic sales and growing halal meat exports to the Middle East, Southeast Asia, and beyond. Strategic initiatives focus on improving productivity through genetic improvement, enhanced nutrition, disease control, and value addition, with targeted investments planned in slaughtering infrastructure, veterinary services, and technology transfer—especially via collaborations like CPEC.

Furthermore, policies aim to boost private sector participation, streamline export procedures, and foster market linkages to position Pakistan’s livestock sector as a competitive player in global markets while supporting sustainable rural development and food security.

Livestock population in Pakistan 2024

|

Admin Units |

Cattle |

Buffalo |

Sheep |

Goats |

Camel |

|||||

|

Pakistan |

55.9 |

% |

47.7 |

% |

44.6 |

% |

95.8 |

% |

1.5 |

% |

|

KPK |

13.5 |

24.2 |

3.9 |

8.2 |

7.6 |

17.1 |

22.5 |

23.5 |

0.1 |

8.1 |

|

Punjab |

27.0 |

48.3 |

29.6 |

61.9 |

13.4 |

30.0 |

31.3 |

32.7 |

0.3 |

16.7 |

|

Sindh |

11.2 |

20.1 |

13.5 |

28.2 |

4.7 |

10.6 |

19.0 |

19.8 |

0.4 |

24.2 |

|

Balochistan |

4.1 |

7.3 |

0.7 |

1.4 |

18.8 |

42.2 |

22.9 |

23.9 |

0.8 |

51.1 |

|

ICT |

0.1 |

0.2 |

0.1 |

0.3 |

0.0 |

0.0 |

0.1 |

0.1 |

0.0 |

0.3 |

- Cattle: Punjab is the major contributor with 48.3 %, followed by KPK (24.2 %) and Sindh (20. Islamabad Capital Territory (ICT) and Balochistan have minimal shares.

- Buffalo: Punjab dominates the buffalo population with 619 %, followed by Sindh (28.6 %), KPK (8.2 %).

- Sheep and Goats: Balochistan leads sheep (42.2 %), followed by Punjab (30.0 %), KPK (17.1 %) and Sindh (10.6 %). Punjab has leading share (32.7 %), followed by KPK and Baluchistan having same share (23.5 and 23.9 %) while Sindh has 19.8 % share.

- Camel: Balochistan has major share (51.1 %) followed by Sindh (24.2 %), Punjab (16.7 %) and KPK only (8. %).

National and provincial Buffalo and Cattle slaughtering trends (000 Numbers)

|

National/ |

Eid Sacrificed |

|

Daily Slaughtered |

Exported |

|

|

|

|

Province |

Cattle |

Buffalo |

Cattle |

Buffalo |

Cattle |

Buffalo |

Total |

|

Punjab |

1,010.00 |

52.00 |

720.00 |

50.00 |

71.00 |

65.00 |

1,897.00 |

|

%age |

62.50 |

53.06 |

51.43 |

8.85 |

63.96 |

52.00 |

|

|

Sindh |

254.00 |

31.00 |

325.00 |

340.00 |

16.00 |

43.00 |

993.00 |

|

%age |

15.72 |

31.63 |

23.21 |

60.18 |

14.41 |

34.40 |

|

|

KPK |

200.00 |

10.00 |

240.00 |

115.00 |

15.00 |

11.00 |

576.00 |

|

%age |

12.38 |

10.20 |

17.14 |

20.35 |

13.51 |

8.80 |

|

|

Balochistan |

152.00 |

5.00 |

115.00 |

60.00 |

9.00 |

6.00 |

338.00 |

|

%age |

9.41 |

5.10 |

8.21 |

10.62 |

8.11 |

4.80 |

|

|

Pakistan |

1,616.00 |

98.00 |

1,400.00 |

565.00 |

111.00 |

125.00 |

3,804.00 |

|

%age |

51.68 |

12.44 |

44.77 |

71.70 |

3.55 |

15.86 |

|

The total cattle slaughter in Pakistan is 3,127,000 heads, and buffalo slaughter is 788,000 heads. Punjab leads in cattle slaughter with 1,801,000 heads and also has a significant buffalo slaughter volume at 167,000 heads. Sindh has a high buffalo slaughter, particularly daily buffalo slaughter and exports, reflecting strong buffalo market activity. KPK and Balochistan have smaller overall slaughter numbers but maintain notable proportions of buffalo slaughter

Punjab should prioritize improving veterinary health and productivity of cattle to optimize Eid and daily market demands due to its large cattle slaughter volume.

- Sindh’s focus should be on enhancing buffalo farming practices and expanding export facilities to support its high buffalo slaughter and export numbers.

- KPK and Balochistan need better animal health services and infrastructure to capitalize on their cattle and buffalo market potential.

- At the national level, enforce hygienic and efficient slaughterhouse operations and manage peak demand during Eid sustainably.

- Strengthen export processes with quality control measures to maximize economic returns from beef and buffalo meat exports.

Sheep and Goat Annual slaughtering trends at provincial and national level

|

Province |

Species |

Eid Sacrificed |

Daily Slaughtered |

Exported |

Total |

|

Punjab |

Goat |

1200.00 |

850.00 |

75.00 |

2125.00 |

|

%age |

56.47 |

40.00 |

3.53 |

100.00 |

|

|

Punjab |

Sheep |

600.00 |

400.00 |

50.00 |

1050.00 |

|

%age |

57.14 |

38.10 |

4.76 |

100.00 |

|

|

Sindh |

Goat |

800.00 |

700.00 |

60.00 |

1560.00 |

|

%age |

51.28 |

44.87 |

3.85 |

100.00 |

|

|

Sindh |

Sheep |

400.00 |

350.00 |

45.00 |

795.00 |

|

%age |

50.31 |

44.03 |

5.66 |

100.00 |

|

|

KPK |

Goat |

650.00 |

500.00 |

40.00 |

1190.00 |

|

%age |

54.62 |

42.02 |

3.36 |

100.00 |

|

|

KPK |

Sheep |

300.00 |

250.00 |

30.00 |

580.00 |

|

%age |

51.72 |

43.10 |

5.17 |

100.00 |

|

|

Balochistan |

Goat |

500.00 |

300.00 |

25.00 |

825.00 |

|

%age |

60.61 |

36.36 |

3.03 |

100.00 |

|

|

Balochistan |

Sheep |

250.00 |

200.00 |

20.00 |

470.00 |

|

%age |

53.19 |

42.55 |

4.26 |

100.00 |

|

|

Pakistan |

Goat |

3150.00 |

2350.00 |

200.00 |

5700.00 |

|

%age |

55.26 |

41.23 |

3.51 |

100.00 |

|

|

Pakistan |

Sheep |

1550.00 |

1200.00 |

145.00 |

2895.00 |

|

%age |

53.54 |

41.45 |

5.01 |

100.00 |

The annual slaughtering trends show that goats are the predominant species slaughtered nationally and provincially. Punjab leads with 2,125,000 goats and 1,050,000 sheep slaughtered, followed by Sindh, KPK, and Balochistan in descending order. Goat slaughtering constitutes around 55% nationwide, with daily slaughter accounting for about 41%. Sheep slaughtering is roughly half that of goats but significant, with about 53% slaughtered during Eid and 41% daily, nationally. Exported numbers remain a small proportion, around 3-5% for goats and sheep.

- Punjab: Enhance goat and sheep health management and breeding programs due to high slaughter volumes; improve market infrastructure and export capabilities; support smallholder farmers with veterinary and feed services.

- Sindh: Strengthen goat and sheep farming practices; address market access and transportation logistics for higher daily slaughter and exports.

- KPK and Balochistan: Focus on improving livestock health services and inputs; encourage farmer training on improved husbandry; invest in rural slaughter and meat processing facilities.

SWOT Analysis of Meat Industry of Pakistan

Strengths:

- Pakistan's meat industry is vibrant with rigorous development in recent years, contributing significantly to the economy with 1.4% of GDP and growth rates of 8-10% in meat production.

- Being a Muslim-majority country (96%), Pakistan produces 100% Halal meat, providing access to a large global market for Halal products.

- Natural resources and capabilities, such as diverse animal breeds, a suitable climate for livestock farming, and an agricultural background, support meat production.

- Proximity to large importers like China, the Middle East, Russia, Iran, and Central Asia enhances export potential.

- Availability of labor and machinery for processing, along with increasing consumer preference toward halal and hygienic meat products.

Weaknesses:

- Infrastructure limitations restrict processing, storage, and marketing capabilities.

- Low value addition with exports mainly limited to carcasses, reducing export revenue.

- Shortage of research and development, volatile animal prices, and lack of control over demand and supply.

- Health concerns about processed meats and higher costs for premium or organic meat products.

- Inconsistent modern husbandry practices and feeding plans hinder productivity improvements.

Opportunities:

- Growing global demand for Halal meat and convenience processed meat products.

- Increasing local and international markets for high-quality, hygienic, and safe meat.

- Potential for modernization, improved processing, development of value-added meat products.

- Government interest in boosting livestock production and export capacities.

- Expanding processed meat market driven by health-conscious, premium consumers and innovative products.

Threats:

- Competition from major meat-exporting countries with more advanced infrastructure.

- Health trends favoring plant-based protein alternatives.

- Market volatility in animal feed and other input costs.

- Regulatory challenges and global trade barriers impacting export growth.

Pakistan’s livestock sector is a massive economic engine, contributing over 63.6% to the agricultural GDP and nearly 15% to the national GDP

About the author:

Dr. Javed Iqbal is an expert in animal sciences, currently serving as a core faculty member at the Riphah College of Veterinary Sciences. With over a decade of dedicated service to the institution, he brings a wealth of specialized knowledge in Animal Breeding and Genetics, a field in which he holds a PhD.

Beyond his academic role, Dr. Iqbal has held significant leadership positions within the public sector, notably serving as the Director of the Research Centre for Conservation of Sahiwal Cattle RCCSC Jhang. His extensive experience also includes an impactful tenure with the Livestock and Dairy Development Department of Punjab, Pakistan, where he contributed to the oversight and growth of one of the country's most vital economic regions.